Social Security Fund - The stability of the Social Security Fund is also at risk as it relies heavily on investments to generate high returns and supplement its income. However, the accelerating increase in the elderly population, particularly due to demographic shifts, poses a critical challenge.

.............................................

At the Cabinet meeting on the 2nd of April, 2024, the Cabinet acknowledged and approved the "Proposal of Policy for the Crisis of Population and Aging Society" as proposed by the National Committee on the Elderly. The Cabinet has assigned relevant agencies to collaboratively implement five proposals:

1. Empower the Working-age Population: Enabling individuals to establish themselves, create and care for a family, and prepare for a quality aging experience in the future.

2. Enhance the Quality and Productivity of Children and Youth: Fewer children but of higher quality

3. Empower the Elderly: Empower the elderly, mitigating the problem, and turning the demographic crisis into an opportunity.

4. Increase Opportunities and Enhance the Value of People with Disabilities.

5. Create a Supportive Ecosystem for Family Stability.

Isranews Agency (www.isranews.org) found that the Ministry of Social Development and Human Security presented the "White Paper - Policy Proposals for the Population and Aging Society Crisis" report at the Cabinet meeting to support the consideration on this issue.

The report highlights 4 main challenges of the "Aged Society," summarized as follows:

@ The Next Decade: Thailand as "a short man carrying a hunchback".

Issue 1: Care and Support for the Elderly: Who will assume responsibility for caring and supporting the elderly—self-care, their family, or the state?

In an aging society, a noticeable trend is the increasing demand for caregivers to assist with the daily activities of the elderly. Survey results highlight a growing need for elderly care as they age.

The proportion of elderly individuals aged 80 and over who rely on caregivers for daily activities is nearly nine times higher compared to those aged 60-69. This underscores that as life expectancy increases, so does the likelihood of depending on others for care and assistance.

Traditionally, children and spouses have been the primary caregivers for the elderly. However, demographic shifts in Thailand have led to an increase in the number of single individuals and childless households. Consequently, fewer elderly people are living with their children, while the number of those living alone or only with a spouse is on the rise.

According to survey on the elderly population, the percentage of elderly individuals living alone has risen from 3.6% in 1994 to 12% in 2021. The proportion of elderly people living alone with their spouse has increased from 11.6% to 21% during the same period. In contrast, the percentage of elderly people living with their children has declined steeply from 72.8% to 49.9%.

The most pressing issue arising from these trends is who will provide care and support for the elderly population in the coming years. Changes in fertility rates are contributing to a decline in the Potential Support Ratio—a measure of the working-age population available to directly care for the elderly or support them indirectly through taxes.

Currently, approximately 3.2 working-age individuals support one elderly person. However, if fertility rates remain unchanged and life expectancy continues to rise, this ratio is expected to decrease to around 2.1 by the next decade. Further declines in fertility could push this ratio even lower.

Additionally, over the next 5-10 years, a growing number of individuals who will soon enter old age or form part of the elderly reserve (aged 50-59 years) will need to care for their elderly parents aged 80 and over. This Parental Support Ratio is projected to decrease from 5.3 individuals in 2024 to just 3.2 individuals by 2034.

These trends indicate that in the next decade, the population will continue to age. Individuals will not only need to prepare themselves for old age but also shoulder the responsibility of caring for elderly relatives in their later years. For those in this generation who face poor health or unstable socioeconomic conditions, there is a risk of falling into a state known as "a short man carrying a hunchback".

@ Social Security Risks of Bankruptcy as Welfare Expenses Soar

Issue 2: Risks of Bankruptcy in the State's Welfare and Security Systems

In Thai society, children have traditionally been the primary caregivers and economic supporters of the elderly. However, a notable trend is the declining number of children per elderly person. Previously, elderly income relied heavily on children, but now it includes earnings from work (32.4%), support from children (32.2%), and living allowances (19.2%). The question of who will economically support the elderly in the future thus becomes a significant challenge.

Consequently, there is a growing importance placed on establishing a comprehensive and sufficient income security and social welfare system for the elderly who are expected to live longer post-retirement.

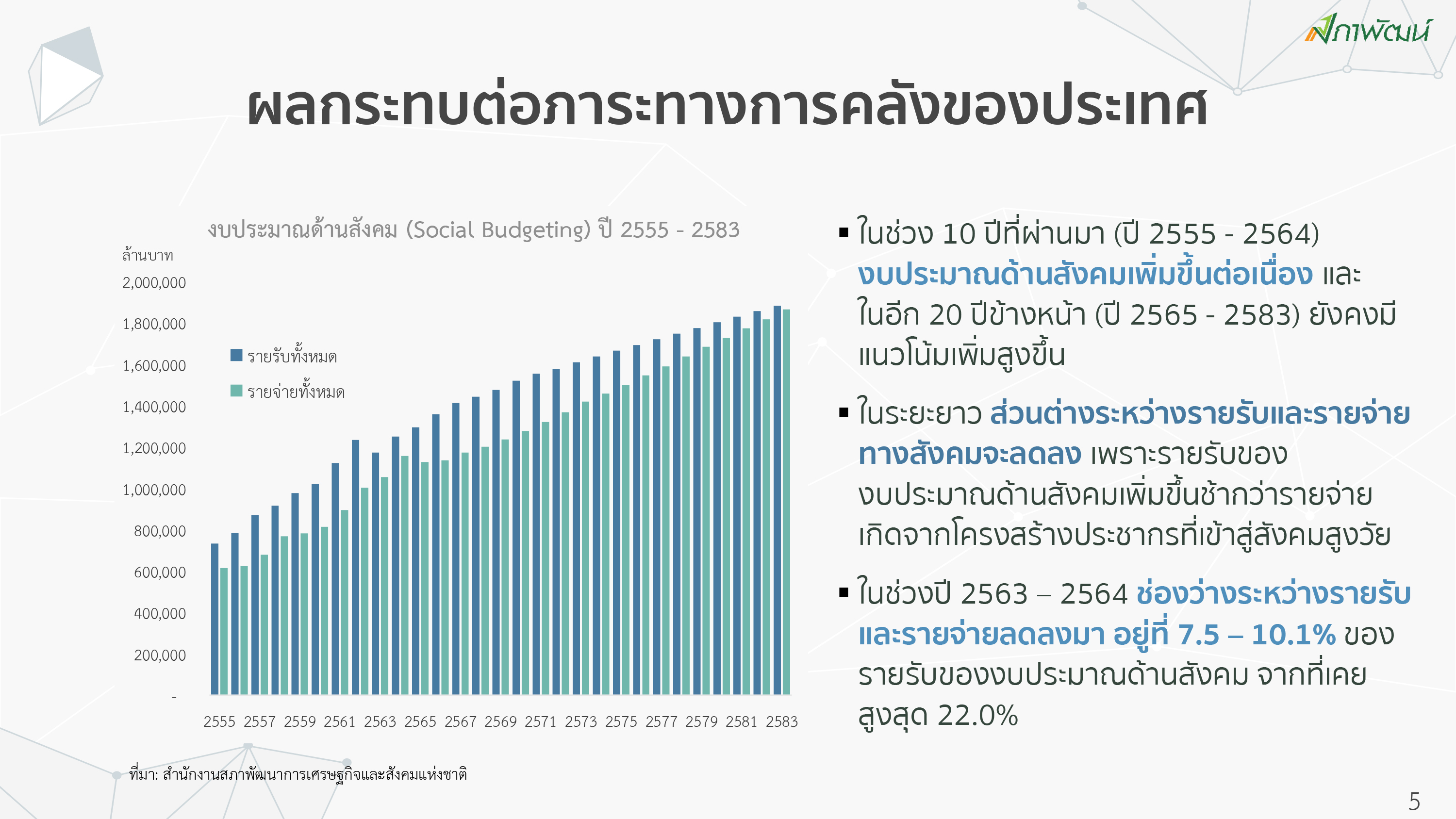

The transition to an aging society is occurring rapidly while Thailand remains a developing nation. This demographic shift significantly impacts the country's financial and fiscal responsibilities, evidenced by the steady increase in social welfare expenditures over the past decade.

From 2020 to 2021, the difference between the Inflow and Outflow social expenditures decreased due to the aging population's changing demographic structure. This gap decreased from a previous high of 22% to approximately 7.5-10.1%. This trend is expected to continue, further straining the stability of various government-prepared welfare systems.

For instance, in the fiscal year 2023, the government allocated approximately 7.7 billion baht for living allowances to 10.3 million elderly individuals. If the payment rate remains constant-ranging from 600 to 900 baht per month depending on age group-this expenditure is projected to increase to 126 billion baht within the next five years and to 140 billion baht by 2034.

Increasing the allowance to 1,000 baht would require up to 189 billion baht within five years, and 3,000 baht could escalate the budget to 568 billion baht.

Social Security Fund - The stability of the Social Security Fund is also at risk as it relies heavily on investments to generate high returns and supplement its income. However, the accelerating increase in the elderly population, particularly due to demographic shifts, poses a critical challenge.

As more individuals transition into retirement, the Social Security Fund needs to cover pension payments for elderly retirees, while the fund's primary income sources traditionally stem from contributions by the working-age population which has dwindled in comparison to the growing number of elderly. This imbalance strains the fund's financial sustainability and raises concerns about potential insolvency.

The universal health insurance system is also under strain due to rising healthcare costs among the aging population. Presently, the government spends approximately 3,957.30 baht per elderly person annually (excluding civil servants). Assuming current per capita expenses persist,

healthcare costs for the elderly could rise to about 62.476 billion baht annually with an expected elderly population increase to 15.78 million in five years. Within ten years, this figure could escalate to approximately 71.655 billion baht annually with an elderly population projected to reach 18.11 million.

@ 'Population Crisis' Drives Rapid Decline in GDP

Issue 3: Declining Child Population and Workforce, and Low Productivity

The diminishing child population and shrinking labor force are contributing to a stagnation and potential decline in Thailand's GDP growth. This demographic trend, characterized by "few children, reduced workforce, and low productivity," poses significant challenges across economic and social dimensions.

To sustain or accelerate development, Thailand requires a highly productive population exceeding current levels in both quality and productivity. The education system must adapt to enhance the quality of childhood development and equip the limited workforce to meet market demands in the digital age.

Historically, educational quality has been a concern, evident in studies showing students' inadequate development of knowledge and skills to meet international standards. According to the World Bank's Human Capital Index assessment in 2017, which evaluates the level of human capital children born today will attain by age 18, Thai children are projected to achieve only 61% productivity from investments in health and education.

In the realm of education, Thai children aged 4 and above receive an average of 12.7 years of schooling by the time they reach 18 years old. However, their actual learning outcomes are equivalent to only 8.7 years of education, as indicated by assessments such as the Programme for International Student Assessment (PISA), which evaluates proficiency in reading, mathematics, and science. Competence in these areas is crucial for thriving in a competitive and fast-evolving global environment.

According to evaluations in 2023, Thailand's performance in mathematics and science assessments has remained below standard over the past two decades. Additionally, reading assessment results have shown a continuous decline.

The demographic crisis, characterized by extremely low birth rates and accelerated aging, poses significant challenges to Thailand's economic development. Despite these trends, the quality of the population remains low, complicating efforts to overcome the "middle-income trap" and limiting market size with fewer producers and consumers. This situation may lead to a decline in economic growth.

The report states that "continued population decline, where births are outnumbered by deaths, weakens private consumption and can rapidly deteriorate the country's GDP.

To mitigate short- and medium-term declines in GDP, it is crucial to bolster the effectiveness of key economic drivers (government spending, private sector investment, and net exports).

However, expanding government spending is constrained by Thailand's current annual budget of 3.48 trillion baht, alongside an annual deficit nearing 1 trillion baht. Any increase in spending must prioritize efficiency to avoid inefficiently increasing public debt.

Regarding net exports, despite efforts to expand opportunities in international markets, non-tariff barriers are increasingly hindering export growth. Meanwhile, private sector investment faces challenges due to Thailand's labor shortage, encompassing both skilled and unskilled workers, and its reliance on relatively low technology.

The fundamental issue hindering the potency of these economic engines is efficiency. Addressing this requires leveraging technology to enhance productivity and compensate for the decline in private consumption resulting from a shrinking population".

@ Thai Families Disappearing: "The Older, the Poorer"

Issue 4: Decline of Thai Families

A significant challenge in Thailand is the gradual disappearance of the traditional family structure. The proportion of one-person households has risen from 16.4% in 2015 to 21.4% in 2022. Additionally, only half of Thai children (aged 0-17) live with both parents. The remaining children either live in single-parent households or apart from their parents entirely.

The prevalence of elderly individuals living alone or with a spouse has also increased, encompassing one in three elderly persons. Conversely, the once predominant arrangement of living with children has dwindled to approximately 50%, reflecting declining fertility rates and increasing instances of singlehood or divorce among older generations. Moreover, many Thai parents who do have children find themselves separated due to work opportunities far from home.

The report also states that although the migration of migrant workers into Thailand—especially unskilled groups that Thai workers often avoid, such as those in construction, agriculture, manufacturing, domestic work, fishing, aquaculture processing, and services—has alleviated the labor shortage to some extent, this has significantly contributed to the Thai economy.

Migrant workers have helped sustain a GDP growth rate of approximately 4-6 percent, equating to around 25 billion US dollars. (It was estimated that in 2022, migrant workers constituted roughly 10 percent of Thailand's total workforce, with the number of registered migrant workers projected to reach approximately 2.74 million in 2023.)

However, while migrant labor may help with short-term demographic challenges, it's a temporary solution. In the long term, neighboring countries will also experience a decline in their working-age populations due to shifting demographic trends towards aging populations.

Simultaneously, Thailand's aging population faces economic insecurity, epitomized by the adage "the older, the poorer" without financial securities. Despite one in three still economically active, predominantly in the informal sector with low and unstable incomes.

Moreover, elderly people are increasingly susceptible to chronic illnesses and dependency, with projections indicating a potential rise from 600,000 in 2015 to over 1.4 million dependent elderly by 2050.

@ NESDC Recommends Expanding the Base of People Entering the Social Security Fund

The accelerating increase in the elderly population, especially the "tsunami of population" entering the elderly age bracket, has raised concerns about the long-term sustainability of the Social Security Fund among government agencies such as the National Economic and Social Development Council (NESDC).

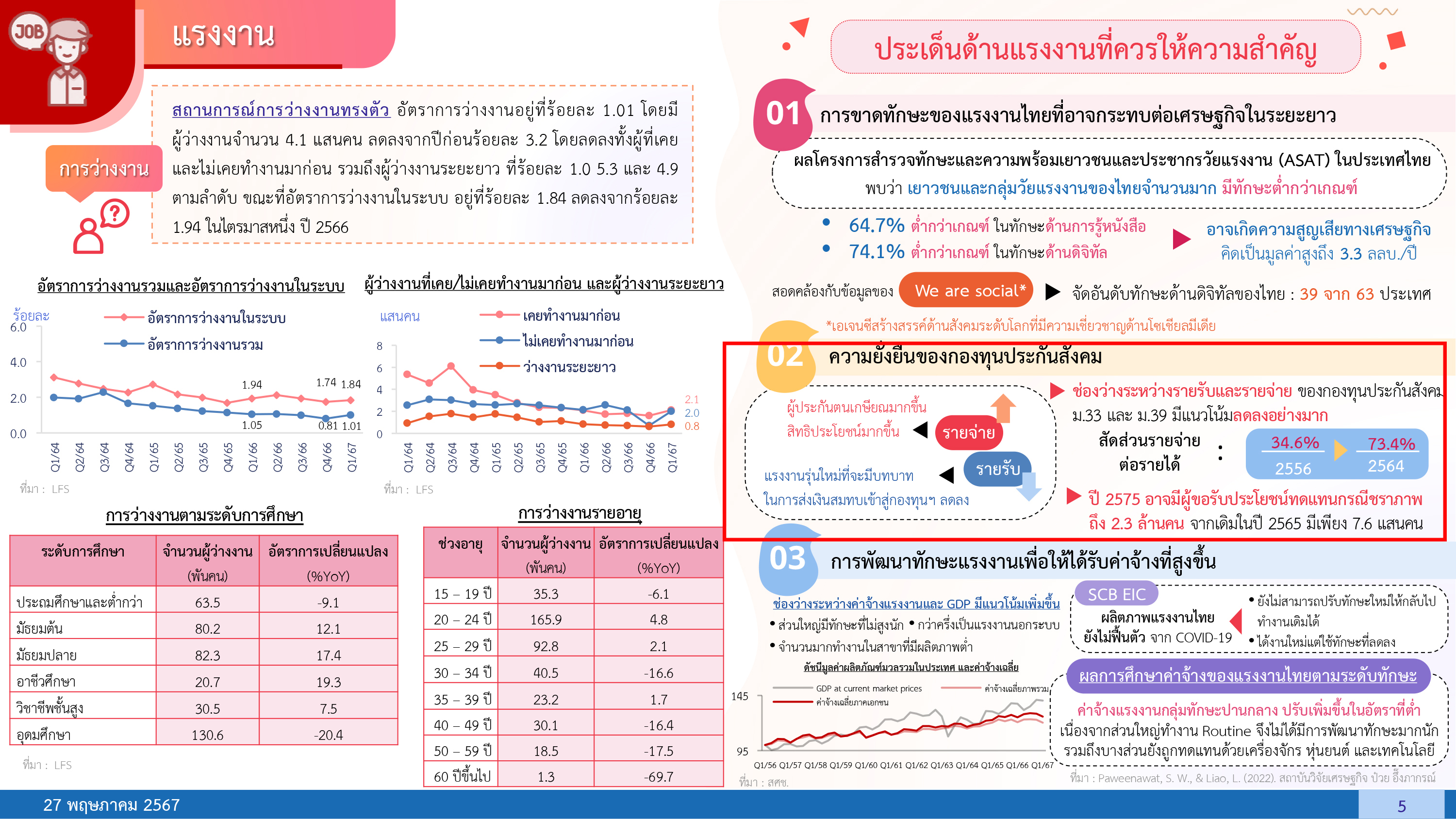

“The current situation of the Social Security Fund shows a widening gap between income and expenses due to the aging of insured persons, leading to increased expenses for the Fund. Meanwhile, fewer members of the younger generation are entering the labor market and the social security system” Danucha Pitchayanan, Secretary-General of the NESDC, stated in a report on the Thai social situation for the first quarter of 2024 on 27 May that

"To address this, there must be effective management of the Social Security Fund, both in terms of revenue management and in expanding the base of individuals entering the social security system. This involves attracting more people to participate in the social security system to ensure its sustainability and effectiveness."

The NESDC found that in 2021, the ratio of expenses to income of the Social Security Fund was 73.4%, an increase from 34.6% in 2013. It is projected that by 2032, the number of people requesting old age benefits may increase to 2.3 million, up from 760,000 in 2022.

(Danucha Pitchayanan, Secretary-General of the NESDB)

(Danucha Pitchayanan, Secretary-General of the NESDB)

The term "tsunami of population" refers to the generation of people born in millions between 1963 - 1983 who are gradually entering the elderly age bracket, or 60 years of age. The NESDC predicts that by 2021 Thailand will have entered a fully aging society, with 20 percent of the population aged 60 years and over. By 2036, it is expected to become an "ultimate aging society," with 30 percent of the population aged 60 years and over.

Previously, Suphannada Lowhachai, an expert in income development and income distribution, and Pataraporn Laowong, an expert in social development investment at the NESDC, jointly presented information at the academic forum "Challenges of Changing Population Structure on Human Security in Thailand" on 12 January 2024.

Suphannada and Pataraporn presented the issue of "Trends of Population Change and Determining Social Welfare Policy in Thailand", pointing out that by 2040, one in three of Thailand's population will be elderly.

Data from the National Transfer Accounts (NTA) found that changes in the Thai population structure alone will cause the country's Life Cycle Deficit (LDC) to increase by 1.34 times during 2019-2040. This demographic shift will also continually increase the fiscal burden, leading to a rise in public debt to GDP by 5.41 percent compared to the previous year by 2040.

Moreover, considering the sources of income and expenditure of all social welfare-related projects, including various funds such as the Social Security Fund, it was found that in 2024, Thailand still has a significant gap in income and expenses—nearly 20 percent.

However, if projected forward to 2040, this gap will rapidly decrease until there is almost no gap left. This is due to the decline in the working-age population, who are the main contributors to these funds, while the number of beneficiaries drawing from the fund will increase enormously in line with the changing population structure.

(the issue of "Trends of Population Change and Determining Social Welfare Policy in Thailand")

(the issue of "Trends of Population Change and Determining Social Welfare Policy in Thailand")

In response to this, Suphannada and Pataraporn have proposed five guidelines for shaping social welfare policy in Thailand:

1. Preparing the Population for Old Age. The focus here is on ensuring that individuals are financially secure before reaching old age. This involves encouraging savings across all age groups and emphasizing behavior adjustment to promote practical savings habits, rather than merely providing education on the topic.

2. Enhancing Social Protection Systems. This means creating opportunities for individuals to move between or connect various systems, such as transitioning from the social security system to other welfare systems, ensuring continuous and maximum benefits.

3. Promoting Innovative Social Operations. Adopting new models such as the Social Partnership Model or Social Impact Bonds that can lead to tangible results.

4. Developing Local Potential. Localities should be empowered to manage their own social projects tailored to their specific contexts. This involves fostering local collaboration through Comprehensive Package to address the uniqueness of different areas.

5. Leveraging Research for Policy Making. Creating a platform that can link and process research findings is crucial for designing effective and evidence-based policies.

(the issue of "Trends of Population Change and Determining Social Welfare Policy in Thailand")

(the issue of "Trends of Population Change and Determining Social Welfare Policy in Thailand")

Encourage Studies on the 'Foreign Countries' Model to Develop Sustainable 'Social Security'

At the same time, the report on consideration of the draft Budget Expenditure Act for fiscal year 2024 by the Special Committee to consider and study the draft Budget Expenditure Act for Fiscal Year 2024 has expressed concern about the future status of the Social Security Fund. Along with recommendations to the Social Security Office in four issues:

1. Review Social Security for Migrant Workers:

- Currently, there are over 1 million migrant workers insured under Section 33 or Section 39 of the Social Security 1990 Act, leading to government obligations of more than 5,000 million baht per year and has a tendency to increase more.

It is recommended to review the appropriateness of the state bearing these contributions and to develop a separate social security system for migrant workers to ensure the long-term sustainability of Thailand's social security system.

2. Increase Public Awareness and Transparency:

- The Social Security Fund should improve communication and publicize its operations, particularly to insured persons. It is crucial to provide accurate information about the fund's status, current accumulated funds, and expenditures to build confidence among insured persons and the general public.

3. Review Contribution Ceilings for Sections 39 and 40:

- The contribution ceilings for insured persons under Section 39 and Section 40 of the Social Security 1990 Act should be reviewed to allow higher contributions. This adjustment would enable insured persons to receive more benefits after leaving work or upon retirement.

4. Study Successful Foreign Social Security Systems:

- It is essential to study highly successful social security systems abroad to develop Thailand's social security system to be sustainable and efficient. This is especially important given Thailand's aging population, which will reduce the number of contributors while increasing the number of beneficiaries.

@Incentives for People to Stay in 'Social Security' Longer

Assoc. Prof. Dr. Sustarum Thammaboosadee, a committee member of the Social Security Fund representing insured individuals, shared with Isranews Agency that the current situation of the Social Security Fund reveals a surplus of contributions over benefits paid out over the past decade. Contributions from employees, employers, and the government exceed the payouts to insured persons.

Regarding the investment returns of the Social Security Fund, despite not always meeting its targets, the fund has amassed substantial profits at almost hundreds of billions of baht.

"Considering only the financial management aspect, the Social Security Fund appears to be meeting its targets based on indicators. The widespread concerns about the impending shift towards an aging society is understandable. This demographic change suggests more retirees compared to new entrants into the workforce, however, it is merely one assumption.

This hypothetical scenario assumes that the population's health dynamics may skew towards more individuals requiring care than actively contributing to the workforce. However, the Social Security itself is akin to other funds for managing welfare services in Thailand. Unlike purely actuarial predictions, which focus on statistical probabilities, healthcare expenditures can vary widely due to the timing and severity of illnesses.

Preparing for the future of Social Security involves anticipating new scenarios, such as potential increases in benefits to ensure higher wages for working-age individuals through bolstering welfare. Addressing the issue of insured individuals disappearing from the system is crucial, alongside initiatives to encourage long-term participation in employment and social security.

Efforts include enhancing maternity leave and childcare support, as well as extending leave options for family caregiving under various conditions. These measures aim to stabilize income and sustain social security contributions over extended periods.

Additionally, considerations are underway to align pension conditions more consistently, potentially increasing pension rights to incentivize longer careers and greater contributions. Experts note that today's workforce exhibits higher productivity compared to previous generations, underscoring the importance of supporting new workers to maintain the stability of the Social Security Fund.

Assoc. Prof. Dr. Sustarum emphasized, "As we move towards an aging society, it's important to recognize that the depletion of the Social Security Fund is not the only inevitable scenario."

(Assoc. Prof. Dr. Sustarum Thammaboosadee)

(Assoc. Prof. Dr. Sustarum Thammaboosadee)

@No Risk of Bankruptcy, But Faces Financial Difficulties"

Assoc. Prof. Dr. Sustarum emphasized that currently, contributions to the Social Security Fund originate from three parties: employers (5% of the employee's monthly income, capped at 15,000 baht), employees (5%), and the government (2.5%). The adequacy of the government's 2.5% contribution will need to be reviewed.

"If we can increase the government's share to 5%, aligning it proportionally with employers and employees, and address outstanding government liabilities to the Social Security Fund, estimated at approximately 50-60 billion baht, we can enhance stability for the system," Dr. Sustarum stated.

Regarding healthcare costs, a significant portion—60% of all benefits paid to insured individuals—is currently allocated to healthcare expenses. He suggested exploring collaboration with the National Health Security Office (NHSO), which specializes in managing severe diseases.

We should discuss with NHSO the possibility of forming a MOU to leverage their expertise in managing certain healthcare areas more efficiently. This partnership could enable the Social Security Fund to better support working-age insured persons and manage chronic illnesses more effectively, potentially reducing expenses in this domain" Dr. Sustarum explained.

Dr. Sustarum discussed the longstanding proposal to raise the ceiling on contributions to the Social Security Fund, a measure under consideration since the previous administration of the Social Security Board. He explained the necessity of the proposal, noting its potential benefits for insured individuals in terms of pensions and unemployment compensation over the long term.

"For individuals earning between 15,000 baht to 20,000 baht per month, a modest increase of 200-300 baht in contributions could significantly impact their future financial security. From the insured representatives’ side, the board's stance is that there are alternative methods to bolster the Social Security Fund. For instance, individuals could opt for voluntary additional contributions to increase their benefits. It is cautious about making such contributions compulsory, particularly during challenging economic periods," stated Dr. Sustarum.

Dr. Sustarum concluded by stating, "Actuarial calculations are based on current factors known for this year. Predicting outcomes over the next 30-40 years is highly uncertain. Take Thailand for example; there were predictions of medical bankruptcies, but the implementation of a 30 baht universal healthcare scheme changed that completely. Actuaries' predictions are therefore quite limited.

Concerning projections that more funds will be expended than received by the Social Security Fund, Thailand has the potential to mitigate this through enhanced workforce skills development, adjustments in benefit structures, and modifications to contribution conditions. These factors can dynamically alter the balance of funds inflow and outflow over time.

Therefore, predictions suggesting the fund will face bankruptcy by 2049 or even by the year 2057 is based on the limited factors available to us currently. Similar to life insurance and private insurance companies, Social Security can adjust its offerings and conditions to attract participants. Even in the worst-case scenario, there may be challenges, but the Social Security Fund will certainly not go bankrupt.”

Amid challenging factors such as the population crisis and aging society, the status of the Social Security Fund faces potential future bankruptcy. Concurrently, the burden of welfare expenses for the elderly in Thailand is increasing annually. Both the government and civil society must collaborate to address these challenges and crises.

อ่านประกอบ :

เปิด‘สมุดปกขาว’กาง 4 โจทย์‘วิกฤติสังคมสูงวัย’ ห่วง‘ประกันสังคม’ล้มละลาย-งบสวัสดิการฯพุ่ง

'กลุ่มผู้สูงอายุ'บุก พม.จี้ 'วราวุธ' เพิ่มเบี้ยคนชรา 1,000 บาทถ้วนหน้าในปีนี้

เพิ่ม'เบี้ยผู้สูงอายุ' 1 พันบาท 'ถ้วนหน้า' ปูทาง'บำนาญประชาชน'?

เปิดรายงาน'กมธ.'ฉบับล่าสุด ชี้ช่อง'แหล่งรายได้'โปะ‘บำนาญประชาชน’-แนะลดงบฯซ้ำซ้อน 4 หมื่นล.

'เครือข่ายภาคปชช.'เรียกร้อง'รัฐบาล'ผลักดันนโยบาย'บำนาญแห่งชาติ'

'วราวุธ'แจงขึ้นเบี้ยผู้สูงอายุถ้วนหน้า 1 พันบาทไม่ได้ ชี้รายรับ-รายจ่าย รบ.สวนทางกัน

ต่างกัน 4 เท่า! เทียบงบ‘เบี้ยผู้สูงอายุ-บำนาญขรก.’10ปี ก่อน‘รบ.บิ๊กตู่’รื้อเกณฑ์จ่ายคนชรา

รายจ่ายยากลดทอน 2 ล้านล.! เปิด‘ความเสี่ยงการคลัง’ล่าสุด หลัง‘นักการเมือง’โหม‘ประชานิยม’

สำรวจนโยบาย 'บำนาญแห่งชาติ-เพิ่มเบี้ยผู้สูงอายุ' สู้ศึกเลือกตั้ง-เสี่ยงภาระการคลัง?

เวทีเสวนาฯชงรีดภาษีมั่งคั่ง-ขึ้นVat หางบโปะ‘บำนาญแห่งชาติ’-ห่วง‘รุ่นเกิดล้าน’แก่แล้วจน

จุดยืนล่าสุด 5 พรรคการเมือง หนุน‘บำนาญแห่งชาติ’ แต่ไม่ฟันธงได้เดือนละ 3 พันบาท ปีไหน!

ข้อเสนอ 'บำนาญถ้วนหน้า' เดือนละ 3 พันบาท ทำได้-ไม่ได้ ใช้เงินเท่าไหร่-หาเงินจากไหน?

จี้เลิกลดหย่อนภาษีคนรวย-เจ้าสัว! ‘ภาคปชช.’เคลื่อนไหวผลักดัน‘บำนาญถ้วนหน้า’ 3 พันบาท/ด.

จาก'สงเคราะห์'สู่'สวัสดิการ' เพิ่ม'เบี้ยผู้สูงอายุ' 3 พันบาท ทางเลือกที่รัฐบาลทำได้?

ผลวิจัยฯชี้เพิ่ม‘เบี้ยยังชีพผู้สูงอายุ’เป็น 3 พันบาท/ด. ต้นทุนเทียบเท่าขึ้นแวต 16.9%

รมว.พม.รับข้อเสนอเครือข่ายประชาชน พัฒนา 'เบี้ยผู้สูงอายุ' เป็นระบบบำนาญ

Isranews Agency | สำนักข่าวอิศรา

Isranews Agency | สำนักข่าวอิศรา